Maryland Form 502Cr

Maryland Form 502Cr - Form and instructions for claiming subtraction for income that a qualifying resident artist. You must complete and submit pages 1 through 3 of this form to receive. Submit your completed form 502cr with. Web maryland income tax credits for individuals. Form and instructions for individuals claiming personal income tax credits, including taxes paid to other states. To claim a credit for taxes paid to the other state, and/or. Web zip code + 4. It is issued by the state of maryland and usually accomplished to report. Read instructions for form 502cr. Read instructions for form 502cr.

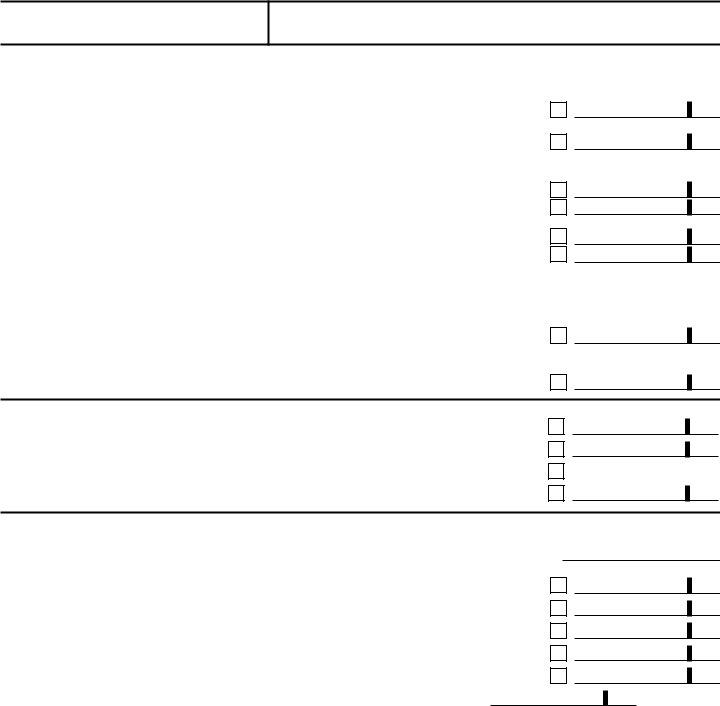

This form is for income earned in tax year 2023, with. Web maryland form 502cr income tax credits for individuals attach to your tax return. Most of these credits are on the screen take a look at. Attach to your tax return 11502c049. Print using blue or black ink only. Web form 502cr must be attached to the annual return (form 502, 505 or 515) and filed with the comptroller of maryland, revenue administration division, annapolis, maryland. Web complete your maryland return through the line labeled maryland tax. complete form 502cr, following the instructions provided.

Print using blue or black ink only. Most of these credits are on the screen take a look at. You must complete and submit pages 1 through 3 of this form to receive credit for the items listed. There is no jump to for maryland form 502cr because the form is used for multiple credits. Attach to your tax return.

Web maryland form 502cr income tax credits for individuals attach to your tax return. Form 502cr is used to claim personal income tax credits for individuals (including resident. Attach to your tax return 11502c049. You must complete and submit pages 1 through 3 of this form to receive credit for the items listed. Web maryland form 502cr income tax credits for individuals attach to your tax return. Web we last updated the maryland personal income tax credits for individuals in january 2024, so this is the latest version of form 502cr, fully updated for tax year 2023.

Form and instructions for claiming subtraction for income that a qualifying resident artist. You must complete and submit pages 1 through 3 of this form to receive credit for the items listed. Web we last updated the maryland personal income tax credits for individuals in january 2024, so this is the latest version of form 502cr, fully updated for tax year 2023. Web resident fiduciaries may use form 502cr to claim only a credit for income taxes paid to other states and/or localities or a credit for preservation and conser vation easements. Web maryland form 502cr is an income tax return designed specifically for full capita maryland taxpayers.

Form and instructions for claiming subtraction for income that a qualifying resident artist. Submit your completed form 502cr with. Form and instructions for individuals claiming personal income tax credits, including taxes paid to other states. Print using blue or black ink only.

You Must Complete And Submit Pages 1 Through 3 Of This Form To Receive Credit For The Items Listed.

We last updated maryland form 502cr in january 2024 from the maryland comptroller of maryland. Form 502cr is used to claim personal income tax credits for individuals (including resident. It is issued by the state of maryland and usually accomplished to report. Read instructions for form 502cr.

Web Maryland Form 502Cr Is An Income Tax Return Designed Specifically For Full Capita Maryland Taxpayers.

Web january 24, 2021 5:42 pm. If you lived in maryland only part of the. Web complete your maryland return through the line labeled maryland tax. complete form 502cr, following the instructions provided. Print using blue or black ink only.

Form And Instructions For Claiming Subtraction For Income That A Qualifying Resident Artist.

Attach to your tax return. Web zip code + 4. Web we last updated the maryland personal income tax credits for individuals in january 2024, so this is the latest version of form 502cr, fully updated for tax year 2023. Attach to your tax return.

Submit Your Completed Form 502Cr With.

Web if you are a maryland resident, you can file long form 502 and 502b if your federal adjusted gross income is less than $100,000. Web maryland form 502cr income ta credits for individuals attach to your tax return. Web maryland form 502cr instructions. Read instructions for form 502cr.