Long Put Calendar Spread

Long Put Calendar Spread - Calendar spreads are also known as ‘time spreads’, ‘counter spreads’ and ‘horizontal spreads’. This strategy profits from a decrease in price movement. Web a calendar spread is an option trade that involves buying and selling an option on the same instrument with the same strikes price, but different expiration periods. Web updated october 31, 2021. There are inherent advantages to trading a put calendar over a call calendar, but both are readily acceptable trades. This spread is considered an advanced options strategy. Options have many strategies that allow you to profit in any market, and calendar spreads are just such a strategy. Web use the optionscout profit calculator to visualize your trading idea for the long put calendar spread strategy. It’s created by simultaneously buying and selling two options of the same type (calls or puts) but with different expiration dates. This strategy can be done with either calls or puts.

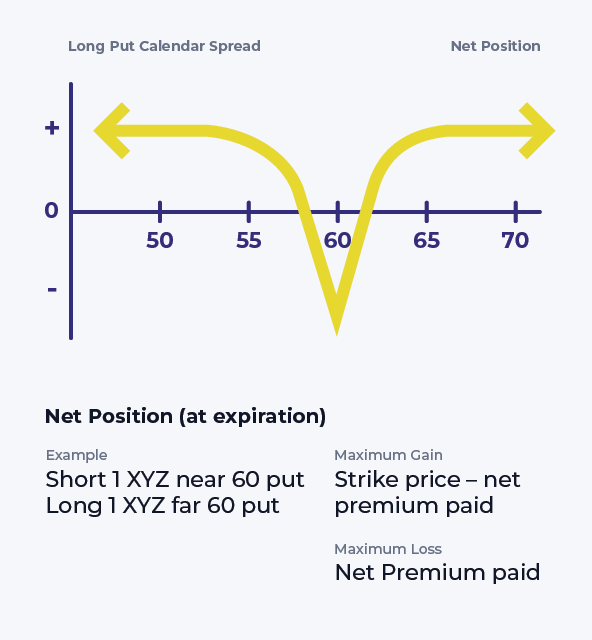

There are inherent advantages to trading a put calendar over a call calendar, but both are readily acceptable trades. Web updated october 31, 2021. Web use the optionscout profit calculator to visualize your trading idea for the long put calendar spread strategy. Option trading strategies offer traders and investors the opportunity to profit in ways not available to those. Check out max profit, max risk, and even breakeven price for a long put calendar spread. Web put calendar spreads primarily bear the risks of unexpected high volatility and significant movement of the underlying asset’s price away from the strike price. Web a long calendar spread is a neutral options strategy that capitalizes on time decay and volatility, rather than focusing on the movement of the underlying stock.

Web a long calendar put spread is seasoned option strategy where you sell and buy same strike price puts with the purchased put expiring one month later. It’s created by simultaneously buying and selling two options of the same type (calls or puts) but with different expiration dates. Web a calendar spread is an options strategy that involves multiple legs. Options have many strategies that allow you to profit in any market, and calendar spreads are just such a strategy. Web a calendar spread is an option trade that involves buying and selling an option on the same instrument with the same strikes price, but different expiration periods.

Web a long put calendar spread involves buying and selling put options for the same underlying security at the same strike price, but at different expiration dates. It involves buying and selling contracts at the same strike price but expiring on different dates. Web a calendar spread is a strategy used in options and futures trading: Calendar spreads are also known as ‘time spreads’, ‘counter spreads’ and ‘horizontal spreads’. Calendar spreads offer traders the flexibility to profit in neutral, bullish, and bearish markets. Check out max profit, max risk, and even breakeven price for a long put calendar spread.

Web a calendar spread is a strategy used in options and futures trading: Web a long put calendar spread involves buying and selling put options for the same underlying security at the same strike price, but at different expiration dates. Depending on where the stock is relative to the strike price when implemented the forecast can either be neutral, bullish or bearish. Maximum risk is limited to the price paid for the spread (net debit). Web a calendar spread is an option trade that involves buying and selling an option on the same instrument with the same strikes price, but different expiration periods.

Web long calendar spreads are great strategies for options traders who believe the stock price will trade near the short option price, allowing traders to profit from “pinning” the future stock price to this strike. Calendar spreads offer traders the flexibility to profit in neutral, bullish, and bearish markets. Web a calendar spread is an options strategy that involves multiple legs. The options institute at cboe ®.

It Involves Buying And Selling Contracts At The Same Strike Price But Expiring On Different Dates.

Calendar spreads are also known as ‘time spreads’, ‘counter spreads’ and ‘horizontal spreads’. Web long calendar spreads are great strategies for options traders who believe the stock price will trade near the short option price, allowing traders to profit from “pinning” the future stock price to this strike. Maximum risk is limited to the price paid for the spread (net debit). It is a strategy used by investors who think the security price will be close to the strike price at expiration.

This Strategy Anticipates A Moderate Drop In.

Check out max profit, max risk, and even breakeven price for a long put calendar spread. Web put calendar spreads primarily bear the risks of unexpected high volatility and significant movement of the underlying asset’s price away from the strike price. Web long put calendar spread: Web a calendar spread is a strategy used in options and futures trading:

Both Options Are Of The Same Type And Generally Feature The Same Strike Price.

It is sometimes referred to as a horiztonal spread, whereas a bull put spread or bear call spread would be referred to as a vertical spread. Web a calendar spread is an option trade that involves buying and selling an option on the same instrument with the same strikes price, but different expiration periods. Web a long calendar spread is a neutral options strategy that capitalizes on time decay and volatility, rather than focusing on the movement of the underlying stock. There are inherent advantages to trading a put calendar over a call calendar, but both are readily acceptable trades.

Option Trading Strategies Offer Traders And Investors The Opportunity To Profit In Ways Not Available To Those.

Web a long calendar put spread is seasoned option strategy where you sell and buy same strike price puts with the purchased put expiring one month later. To profit from neutral stock price action near the strike price of the calendar spread with limited risk in either direction. Web a calendar spread is an options strategy that involves multiple legs. Depending on where the stock is relative to the strike price when implemented the forecast can either be neutral, bullish or bearish.

![Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://i2.wp.com/assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/6019b83133ac2d32ef084fa5_TsbQgZxQ0e-zKJ9h6Fa7azNlnvn0zH-UBlX3l7hriHll2es1fvyFY5N-nOyM1153MJ4wXLNIhH4zanFkJQB0mpqs81lwEBIvqa7IZQRPWXZY1i3J7vV3BpTIL3v5nCyqn-CEbq2U.png)