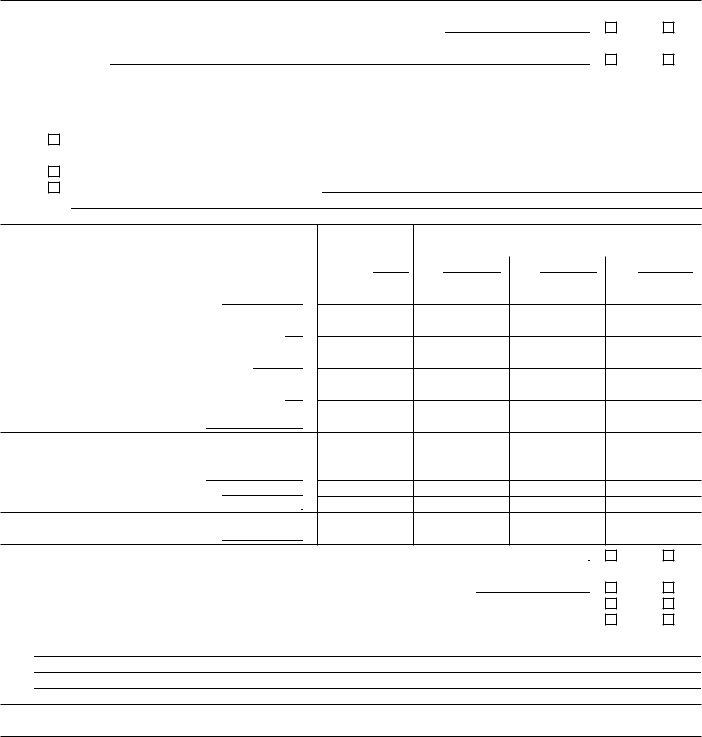

Form 1028 Michigan

Form 1028 Michigan - Web here's how it works. Web these instructions explain how to create and submit the uia 1028 wage/tax report, which must be submitted to the michigan unemployment insurance agency every quarter. Share your form with others. Web link to official form info: Web compliance with filing form uia 1028, employer’s quarterly wage/tax report, online through miwam will help ensure efficient processing of the employer’s quarterly tax report and payment. For step by step instructions on how to use miwam, including how to file your employer’s quarterly wage/tax report or make a payment, view the miwam toolkit for employers on www.michigan.gov/uia and. Form uia 1028, employer’s quarterly wage/tax report, replaces the following forms: Sign it in a few clicks. The uia form 1028 is a document that allows you to claim an exemption under internal revenue code section 501 (c) (3). See related links below for required setup information before creating the state wage report.

Web compliance with filing form uia 1028, employer’s quarterly wage/tax report, online through miwam will help ensure efficient processing of the employer’s quarterly tax report and payment. Get form now download pdf. Each calendar quarter, a contributing employer files a uia 1028 with the uia, called a employer's quarterly wage/tax report. Your cooperation is needed to make the results of this survey complete, accurate, and timely. Form uia 1028, employer’s quarterly wage/tax report, replaces the following forms: Web for the next 10 calendar days you may submit form uia 1028 and make tax or reimbursement payments through your miwam account. Enter the wage and tax information for that quarter.

This new form will replace the following forms: State real estate transfer tax (srett) tax clearance. Draw your signature, type it, upload its image, or use your mobile device as a signature pad. The ui tax funds unemployment compensation programs for eligible employees. If you have an outstanding return, it will appear under “period alerts.”.

Michigan requires all employer's wage/tax reports to be filed online. Upcoming due dates in the next year:* tuesday apr 30, 2024. If you have an outstanding return, it will appear under “period alerts.”. This report is authorized by law, 29 u.s.c. Web compliance with filing form uia 1028, employer’s quarterly wage/tax report, online through miwam will help ensure efficient processing of the employer’s quarterly tax report and payment. This new form will replace the following forms:

Employer’s wage/tax reports must be filed online through your miwam account. Web documentation of michigan nonresidential property tax paid for cy 2020, and bill for summer and winter nonresidential property tax (if applicable) copy of facility lease evidencing lease cost (if applicable) copy of employer’s quarterly report uia form 1028 (if applicable) 2019 and 2020 federal income tax returns Web april 18, 2021 10:02 am. Web link to official form info: Department of licensing and regulatory affairs.

Web there are two methods for taxing employers for unemployment insurance. Enter your password and click “ok.”. Upcoming due dates in the next year:* tuesday apr 30, 2024. Share your form with others.

You Will Need The Code To Access Your Account After The 10 Day Limited.

Web now those forms have been consolidated into just one—the new form uia 1028. Sign online button or tick the preview image of the blank. Upcoming due dates in the next year:* tuesday apr 30, 2024. This new form will replace the following forms:

This Report Includes All Gross Pay Records For The Quarter Submitted, Except Gross Pay With Earnings Codes Bpann, Stdnt, Tpuly, Wcpay And Xfica.

Form uia 1028, employer’s quarterly wage/tax report, replaces the following forms: After entering your employees’ wages, you’ll be prompted to enter your miwam password. To get started on the document, use the fill camp; State real estate transfer tax (srett) tax clearance.

Share Your Form With Others.

Web for the next 10 calendar days you may submit form uia 1028 and make tax or reimbursement payments through your miwam account. Draw your signature, type it, upload its image, or use your mobile device as a signature pad. Ever since last upgrade there is no way for me to access this. Employer’s wage/tax reports must be filed online through your miwam account.

The Totals On This Form Must Match The Corresponding Totals On Your Employer's Quarterly Wage/Tax Report (Uia 1028).

I need last quarters mi 1028 form in order to file my quarterly form with the state. Sign it in a few clicks. Your cooperation is needed to make the results of this survey complete, accurate, and timely. Type text, add images, blackout confidential details, add comments, highlights and more.